Last week, the cryptocurrency industry clarified its desire and intent to circumvent the American banking system. In a letter of support for the creation of so-called “skinny accounts” at the Federal Reserve, the Blockchain Payment Consortium praised the Fed’s efforts to, “finally offer viable alternatives to commercial bank intermediaries.”

The letter went on in a section worth quoting in full:

“Commercial banks lack the proper economic and commercial incentives to be honest actors in a competitive market that includes the stablecoin economy. We see this today as banks continue to lobby against competitive stablecoin interest rates for everyday people. Direct Fed access would allow stablecoin issuers to settle in the safest asset class and address intermediary risks inherent with commercial bank deposits — a primary cause of market volatility during the 2023 regional banking crisis. As witnessed then, it was the mismanagement of Silicon Valley Bank (“SVB”) that led to stablecoin volatility, not the other way around.”

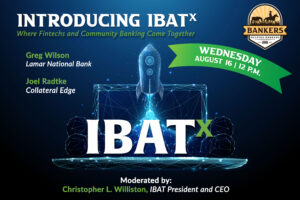

IBAT filed its own letter last week, noting that the proposal will heighten concerns regarding bank liquidity, complicate reserve management, undermine the current BSA/AML regime and, ultimately, put commercial banks at a competitive disadvantage to fintech providers.

“It is clear that stablecoin issuers and other fintech companies are aiming to dismantle the American banking system as we know it,” said IBAT President and CEO Christopher Williston. “They see the world in terms of efficiency and transactions, with no appreciation for how the totality of a bank balance sheet amounts to economic productivity and the enrichment of people in a community. Community bankers must keep up the fight with vigor.”